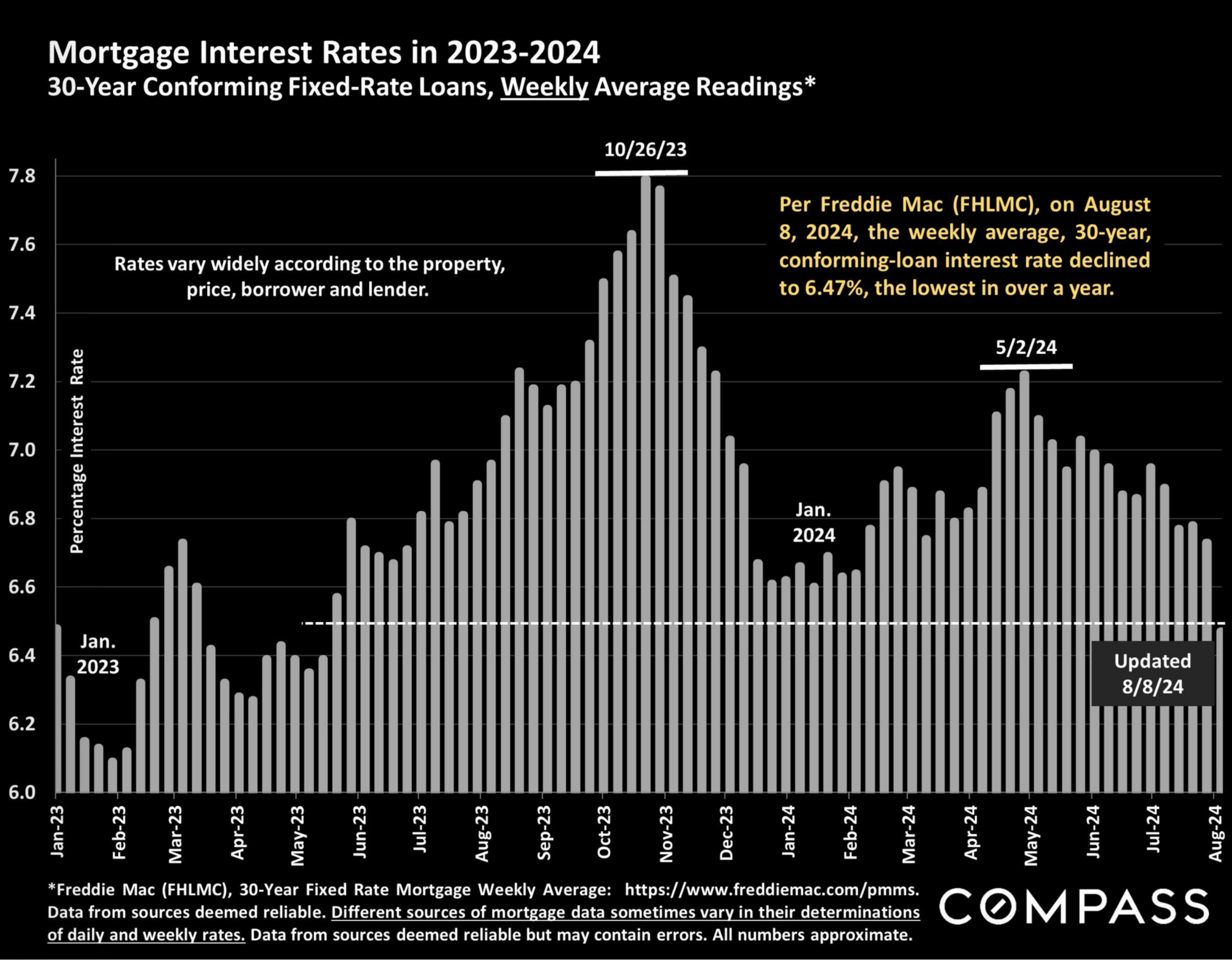

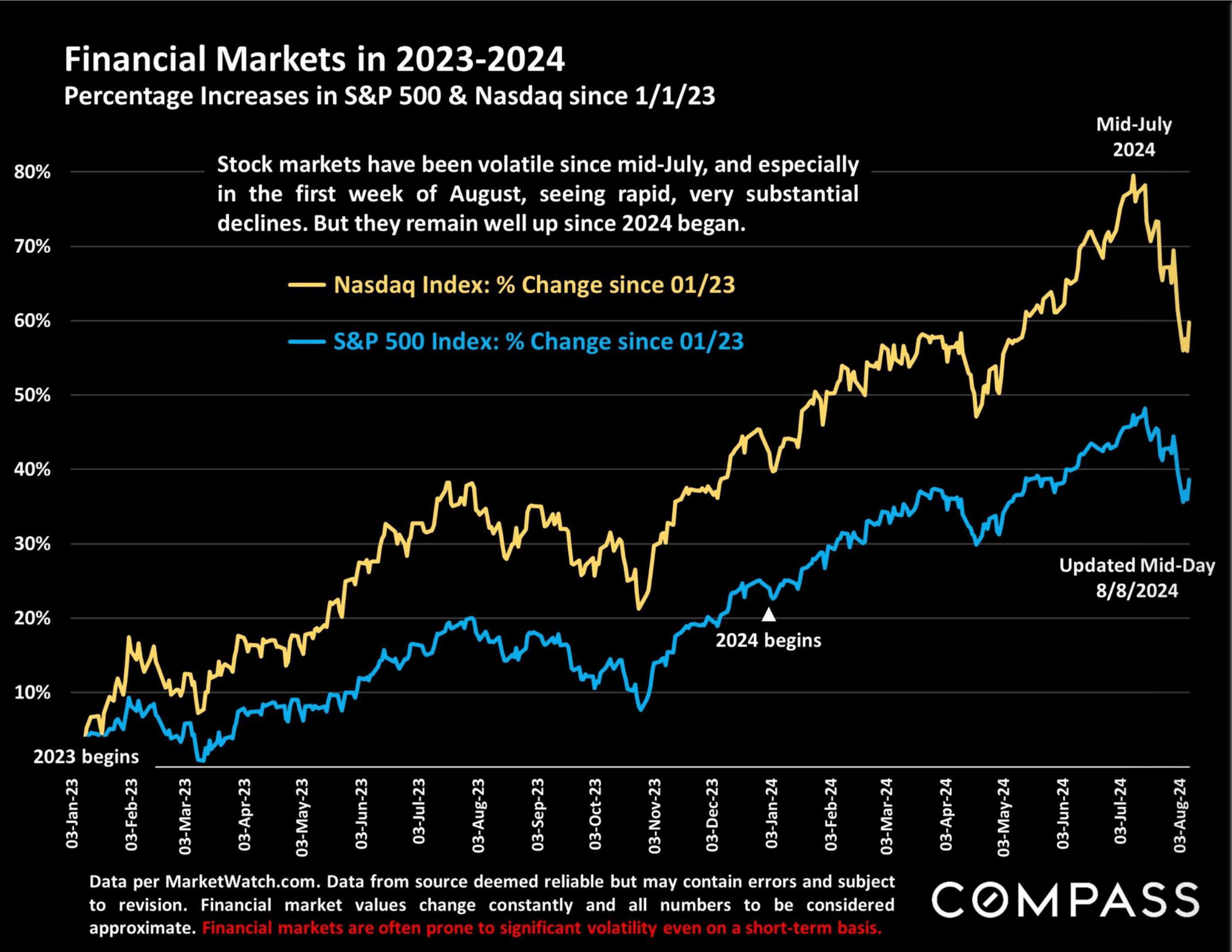

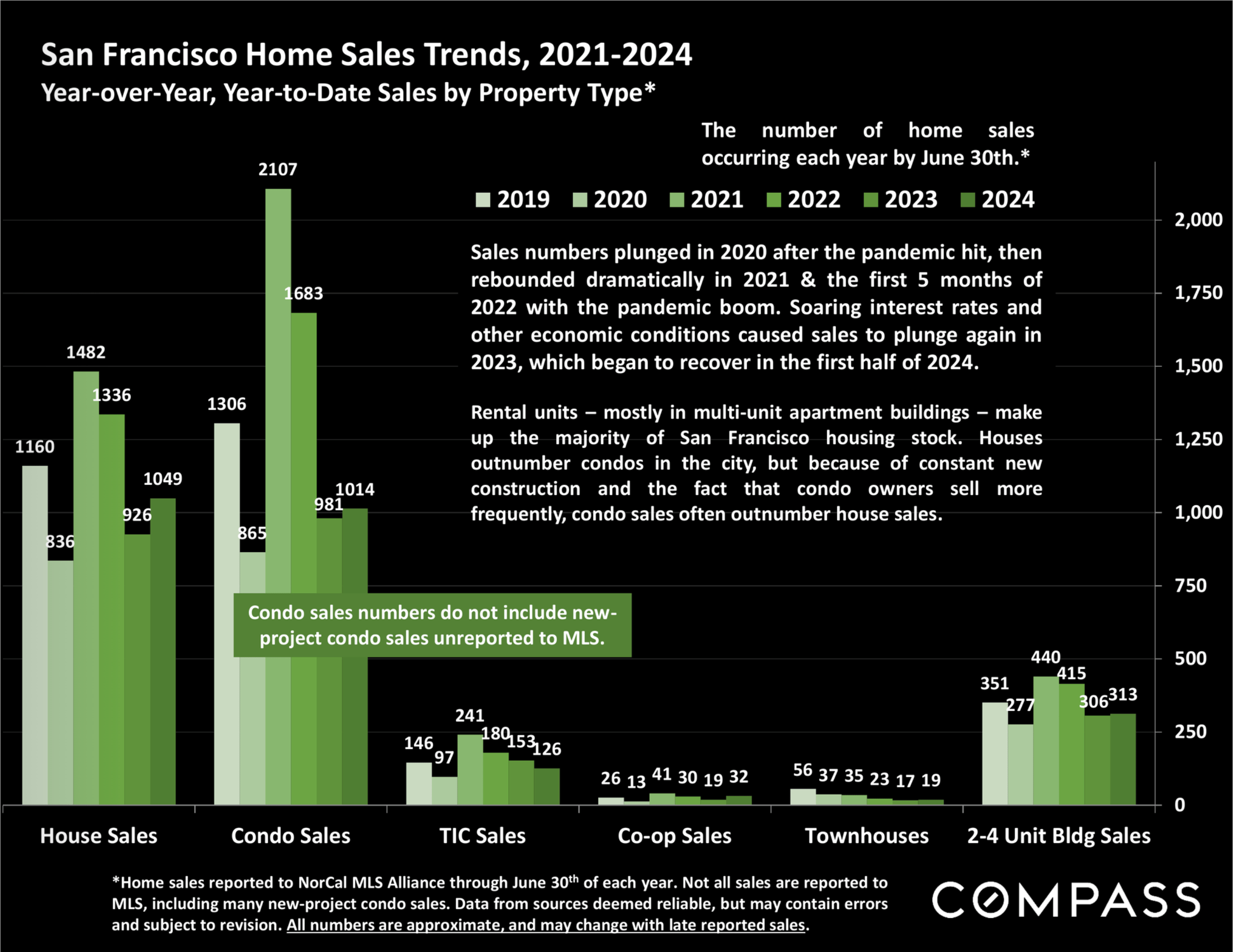

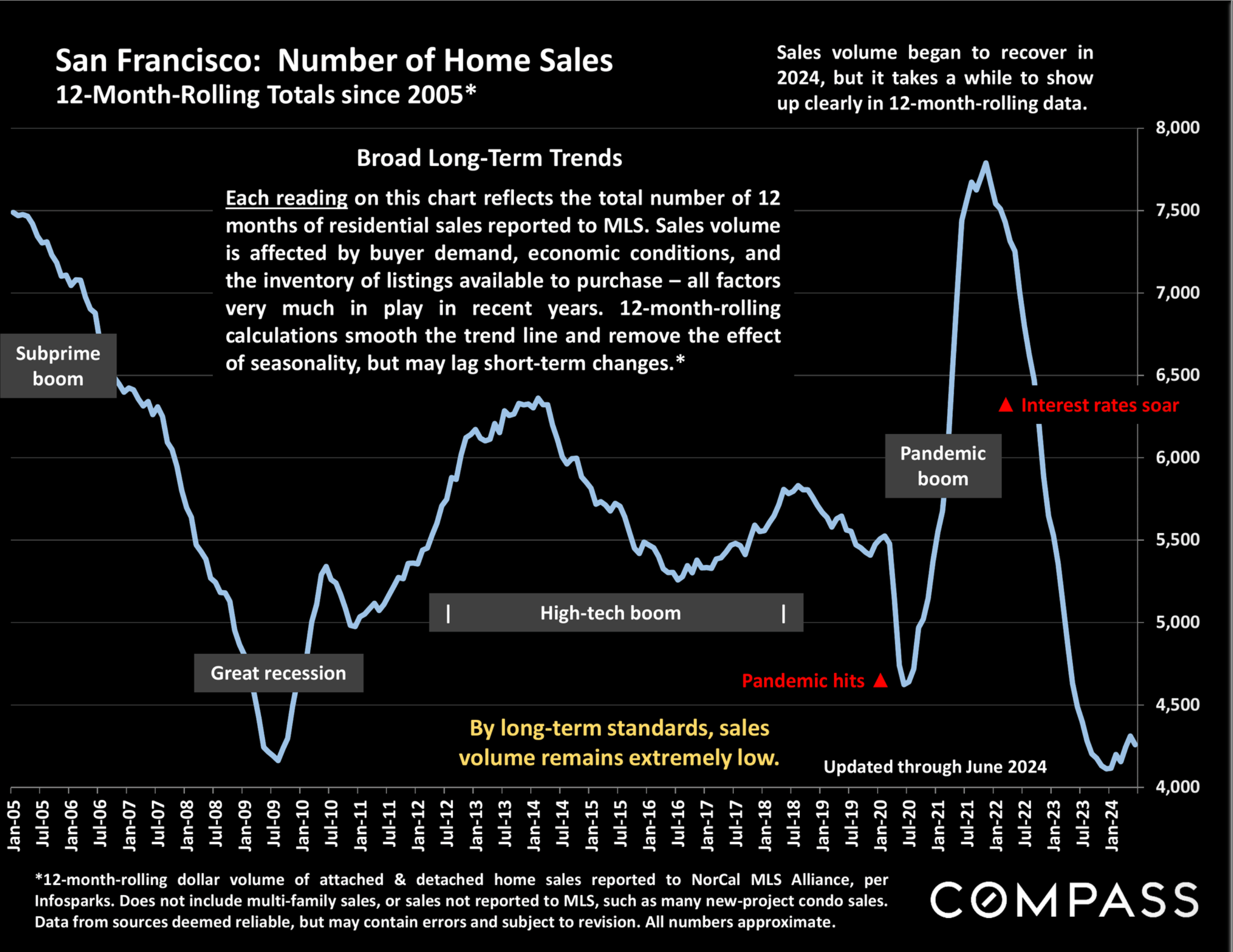

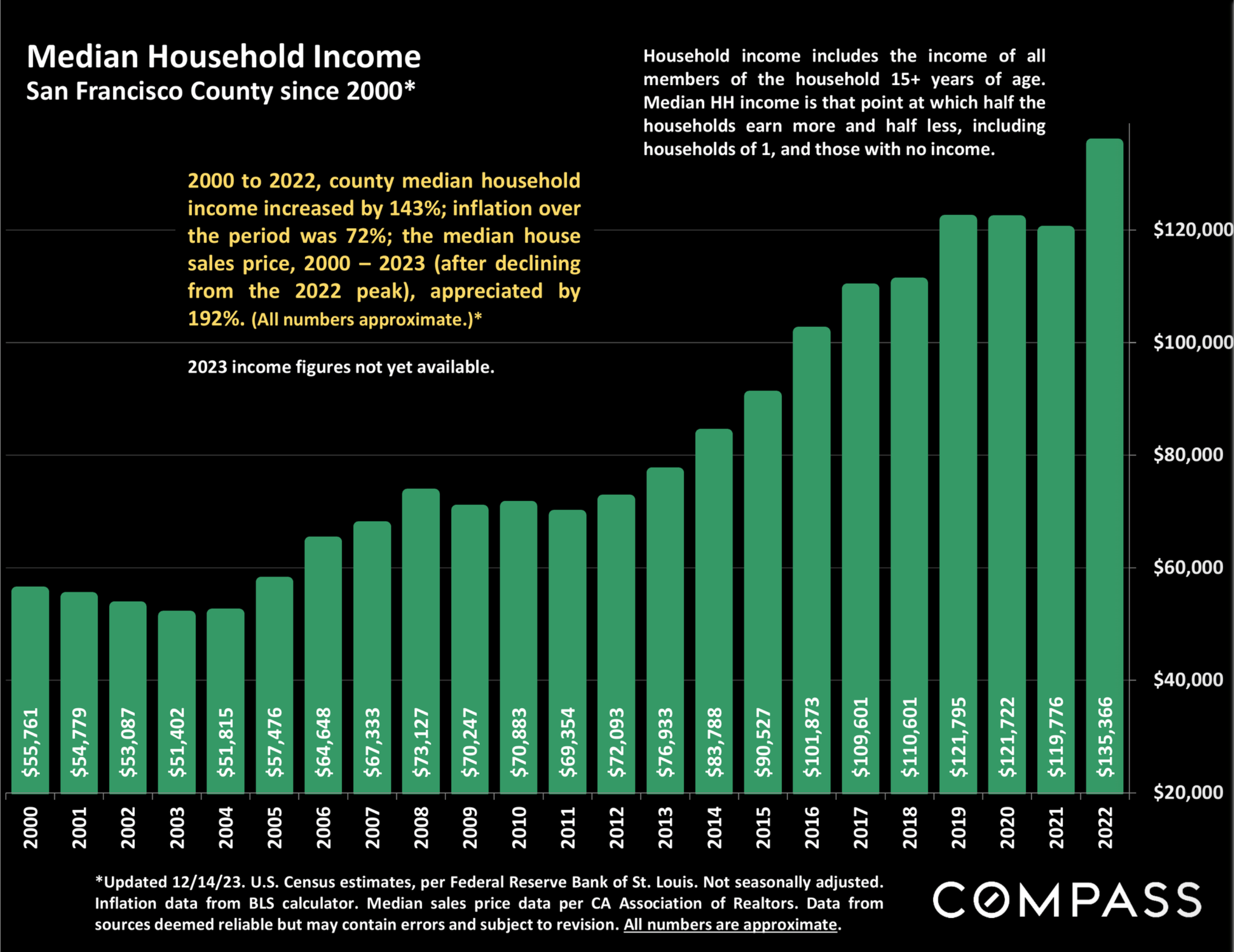

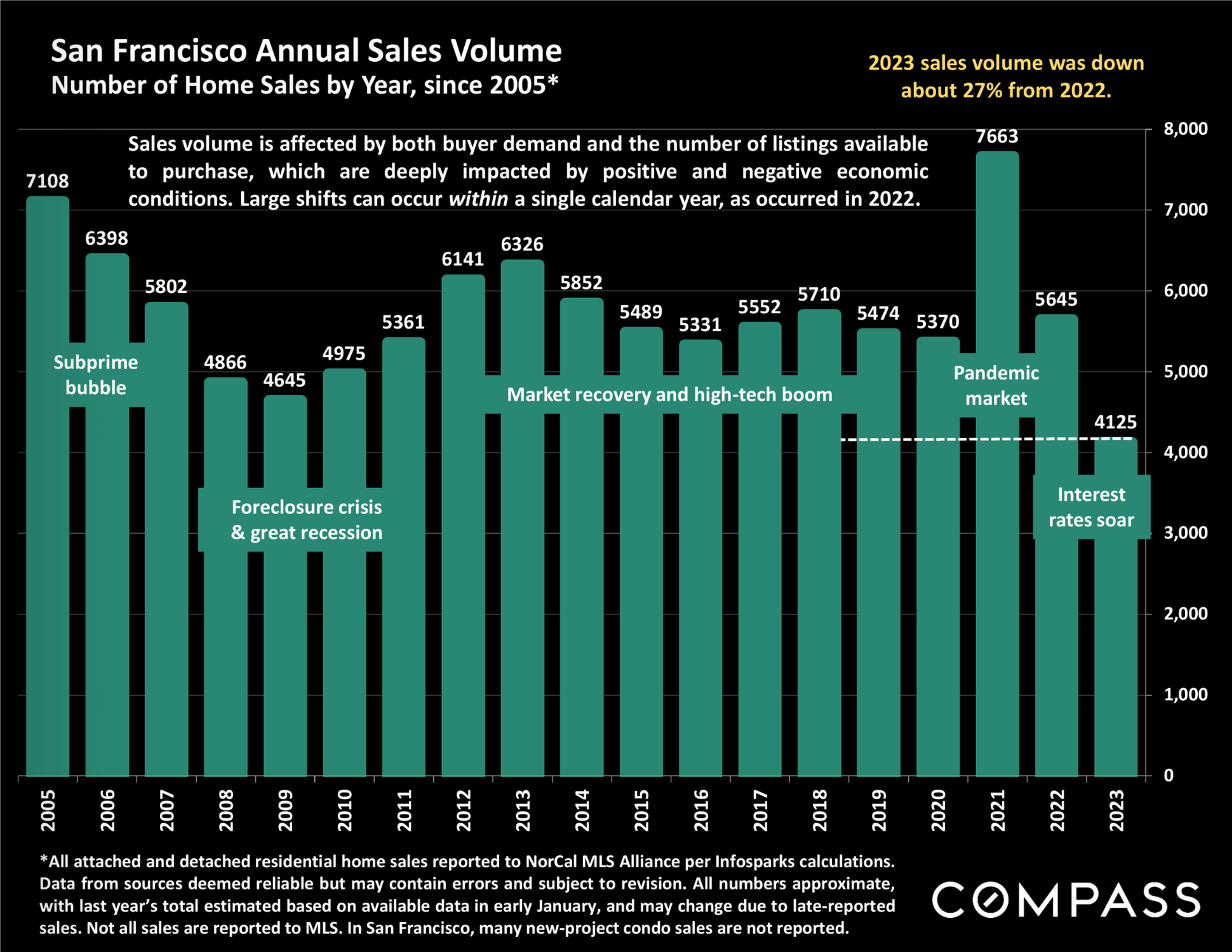

As of August 8th, mortgage rates had declined to their lowest point in over a year, while financial markets were experiencing very substantial volatility. Most analysts believe the Fed will finally begin to drop their benchmark rate in September (pending a positive inflation report in mid-August). Lower interest rates, of course, have considerable effect on the cost of homeownership for those financing their purchase, and a sustained decline would almost certainly spark increased market activity – not only of buyers, but potentially of sellers who held off listing their homes in the past 2 years due to the “mortgage lock-in” effect. Much depends on the scale of any decline in rates – as well as possible changes in other economic conditions – through the end of the year.

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).